HANetf thematic ETFs

HANetf - Discover new investing frontiers

HANetf was founded by two of Europe’s leading ETF pioneers with over 40 years’ combined ETF experience: Hector McNeil and Nik Bienkowski. Hector and Nik have been a pioneering force in the industry, establishing and building successful companies including ETF Securities, Boost ETP, and WisdomTree Europe.

In 2017, Hector and Nik started HANetf to provide a full ETF white-label operational, regulatory, distribution and marketing solution. As ETF and ETC specialists, HANetf work with global experts to provide new and innovative investment opportunities.

HANetf has become the leading issuer of thematic ETFs and ETCs in Europe. Among its range are Europe’s largest uranium ETF by AUM, Europe’s first Metaverse ETF, and Europe’s first ESG-screened copper miners ETF. Almost two thirds of its ETFs are classified as Article 8 under the Sustainable Finance Disclosure Regulation (SFDR), and one is Article 9.

Beyond thematic ETFs, HANetf also launched also launched the first gold ETC in partnership with a European sovereign mint. The Royal Mint-backed gold ETC is 100% physically backed by London Bullion Market Association (LBMA) post-2019 responsibly sourced good delivery bars – the highest available standard. Over half the bars in its custody are 100% recycled gold.

HANetf also has a physically backed carbon ETC, as well as 6 cryptocurrency ETCs - including Europe’s first centrally cleared Bitcoin ETP, ETC Group Physical Bitcoin.

In 2017, Hector and Nik started HANetf to provide a full ETF white-label operational, regulatory, distribution and marketing solution. As ETF and ETC specialists, HANetf work with global experts to provide new and innovative investment opportunities.

HANetf offer

HANetf has become the leading issuer of thematic ETFs and ETCs in Europe. Among its range are Europe’s largest uranium ETF by AUM, Europe’s first Metaverse ETF, and Europe’s first ESG-screened copper miners ETF. Almost two thirds of its ETFs are classified as Article 8 under the Sustainable Finance Disclosure Regulation (SFDR), and one is Article 9.

Beyond thematic ETFs, HANetf also launched also launched the first gold ETC in partnership with a European sovereign mint. The Royal Mint-backed gold ETC is 100% physically backed by London Bullion Market Association (LBMA) post-2019 responsibly sourced good delivery bars – the highest available standard. Over half the bars in its custody are 100% recycled gold.

HANetf also has a physically backed carbon ETC, as well as 6 cryptocurrency ETCs - including Europe’s first centrally cleared Bitcoin ETP, ETC Group Physical Bitcoin.

Promotion for Directa Customers

From March, 13th 2023 ZERO fees trading* on a pool of HANetf thematic ETFs

The promotion is valid only on buy orders with minimum trade value of € 1,000

The list of products is available here

The list of products listed on Xetra Market is available here

From March, 13th 2023 ZERO fees trading* on a pool of HANetf thematic ETFs

The promotion is valid only on buy orders with minimum trade value of € 1,000

The list of products is available here

The list of products listed on Xetra Market is available here

* No trading fees are charged for buy orders with a trade value of 1,000 euros or more. HANetf pays Directa a retrocession for each execution.

HANetf Products

- Sprott Uranium Miners UCITS ETF | U3O8 seeks to provide investors with a way to invest in the growth of nuclear power through exposure to uranium miners.

This comprises companies involved in the uranium industry, spanning the mining, exploration, development and production of uranium. The ETF also invests in entities that hold physical uranium, uranium royalties, or other non-mining assets.

Nuclear is increasingly viewed as critical to the clean energy transition, and demand for uranium is set to surge. Uranium miners could be poised to benefit from this trend.

The uranium miners tracks the North Shore Sprott Uranium Miners Index (URNMX), which seeks to invest in holdings that have a significant part of their business operations related to uranium mining, exploration for uranium, physical uranium investments, and technologies related to the uranium industry.

- Future of Defence UCITS ETF | NATO provides exposure to the companies generating revenue from NATO and NATO+ ally defence and cyber defence spending.

Global military spending is rising. In 2023, .2 trillion was spent on defence — the highest level ever recorded. With the ongoing geopolitical tensions, one area of growth is among European NATO members. But despite such record spending, most European NATO members are still lagging the 2% of GDP target.

But defence is no longer just about physical borders and military strength – since the full-scale invasion of Ukraine in 2022, state-sponsored actors have targeted hundreds of governmental organisations in dozens of countries that support Ukraine, highlighting the importance of cyber defence.

The Future of Defence ETF tracks the EQM Future of Defence Index (NATONTR). Using a passive, rules-based approach, companies must derive more than 50% of their revenues from the manufacture and development of military aircraft and/or defence equipment or have business operations in cyber security contracted with a NATO+ member country.

- Emerging Markets Internet & Ecommerce UCITS ETF | EMQQ provides exposure to the growth of online consumption in the developing world as middle classes expand and affordable smartphones provide unprecedentedly large swaths of the population with access to the internet for the first time.

The plunging costs of smartphones and wireless broadband are providing unprecedentedly large swaths of the population in developing countries with access to the Internet for the first time, enabling revolutions not just in consumption patterns, but also digital payments, communication, healthcare, education, entertainment, grocery delivery and more. EMQQ seeks to capture this development.

The fund tracks the EMQQ Emerging Markets Internet & Ecommerce Index (EMQQITR), an index of leading internet and ecommerce companies that serve emerging markets, including search engines, online retailers, social networks, online video, online gaming, e-payment systems and online travel.

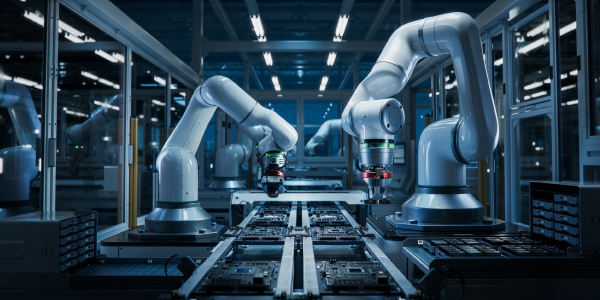

- HAN-GINS Tech Megatrend Equal Weight UCITS ETF | ITEK seeks to provide exposure to the disruptive technology companies in “Industry 4.0” that are changing the world through global megatrends.

ITEK provides equal weight access to companies that are driving innovation in eight sub-sectors including Robotics & Automation, Cloud Computing & Big Data, Cyber Security, Future Cars, Genomics, Social Media, Blockchain and Digital Entertainment.

The fund avoids concentration in larger stocks such as the FAANGs (Facebook, Amazon, Apple, Netflix, Google) by using a double diversification approach that allocates an equal weight to each innovative theme and then equal weights constituents within that theme.

The tech megatrend ETF tracks the Solactive Innovative Technologies Index (SOLITEK), which focused on companies poised to benefit from the fourth industrial revolution.

- Alerian Midstream Energy Dividend UCITS ETF | MMLP aims to provide diversified exposure to midstream energy companies involved in the processing, transportation, and storage of oil, natural gas, and natural gas liquids in the US and Canadian markets. The fund includes both master limited partnership companies (MLPs) and C-corps.

Given the fee-based nature of midstream, cash flows are less sensitive to commodity price volatility compared to other sectors of energy, such as oil and gas producers, making the fund defensive in times of high inflation.

The midstream energy ETF tracks the Alerian Midstream Energy Dividend Index (AEDWN). By employing a synthetic strategy, the midstream energy ETF enables efficient replication of the index.

- AuAg ESG Gold Mining UCITS ETF | ESGO seeks to offer exposure to an equal-weighted basket of 25 ESG screened companies that are active in the gold mining industry.

ESGO uses Sustainalytics to screen the mining universe for their ESG credentials, attributing a risk score based on their findings. Only the top 25 lowest ESG Risk companies are included within the index. The equal-weighted design also helps to avoid concentration risks; the possible underweighting of a few dominant mega-companies may also provide a beneficial return profile for ESGO in a bull market for gold and gold miners.

The fund tracks the Solactive AuAg ESG Gold Mining Index (SOLESGON) which focuses on companies that have low ESG risk characteristics.

- iClima Global Decarbonisation Enablers UCITS ETF | CLMA is the world’s first climate change ETF that provides exposure to the performance of companies offering products and services that enable CO2e avoidance

The fund is unique because it shifts the focus from companies’ emission reduction actions to companies offering products and services that directly enable CO2e avoidance solutions and shines a spotlight on climate change innovators.

The climate change ETF tracks the iClima Global Decarbonisation Enablers Index (GLCLIMUN), an index designed to measure the performance of securities from five sub-sectors including green energy, green transportation, water and waste improvements, decarbonisation enabling solutions and sustainable products.

- Digital Infrastructure and Connectivity UCITS ETF | DIGI seeks to capture companies that enable the digital applications of today and those that will redefine how people work, live, and play tomorrow. It provides exposure to the explosive growth of the digital infrastructure virtuous cycle of expanding data, applications, and bandwidth that drives exponential network growth and development of new technologies.

The buildout of 5G and beyond will dramatically accelerate the trends of digitalisation and virtual communication and with that arises a growing and insatiable need for digital infrastructure and connectivity to support these digital activities and the immense amount of data flowing behind them. DIGI aims to capture this growth.

The digital infrastructure ETF tracks the Tematica BITA Digital Infrastructure and Connectivity Sustainability Screened Index (TBDIGI), which comprises over 80 publicly listed global equities that support the following six key functions: data centres; data networks; digital connectivity; digital transmission; digital processing; and digital solutions and IP.

- Saturna Al-Kawthar Global Focused Equity UCITS ETF | AMAL is an actively managed global equity ETF focusing on Shariah-compliant stocks with positive ESG characteristics.

The fund aims to achieve long-term capital appreciation and exhibits the primary features of Islamic financial products: it is asset backed, ethical, shares risks equitably and is subject to good governance. AMAL typically invests in 30-45 high quality, attractively priced global companies that are best-in-class on a variety of ESG, financial and valuation metrics and have solid growth prospects. The ETF invests globally and is benchmark agnostic in terms of geographic and industry allocations.

It is managed by a highly experienced team from Saturna Capital Corporation; a billion asset management firm with over 31 years’ experience managing Islamic and socially responsible investment strategies.

- Sprott Junior Uranium Miners UCITS ETF | URNJ provides exposure to small- and mid-cap uranium miners that offer the potential of outperforming in the near future.

A new bull market is likely underway, incentivising miners to explore and develop new uranium mines and potentially allowing for smaller miners to experience significant growth. Nuclear power’s essential role in the net-zero transition is driving demand for uranium, and miners will need to step up.

The junior uranium miners ETF tracks the Nasdaq Sprott Junior Uranium Miners Index (NSURNJ), which is made up of a basket of uranium mining companies selected based on their potential for revenue and asset growth.

- Sprott Energy Transition Materials UCITS ETF | SETM provides exposure to the companies that are providing the critical materials needed for the global clean energy transition.

There is a global movement towards removing our dependence on fossil fuels in favour of low-carbon and renewable energy sources. Transitioning to a greener economy means moving from an economy that is dependent on carbon to one that is more dependent on various metals and materials.

As a result, demand for these critical materials should boost their prices. We believe companies that are upstream in the supply chain will benefit from the increased investment in the critical minerals necessary for the clean energy transition.

The energy transition materials ETF tracks the Nasdaq Sprott Energy Transition Materials Ex Uranium Index (NSETMU), which is designed to track the performance of a selection of global securities in the energy transition materials industry.

- INQQ India Internet & Ecommerce ESG-S UCITS ETF | INQQ provides investors with targeted exposure to the India internet and ecommerce sector.

Simultaneously, India has been rapidly expanding its digital infrastructure, allowing for unprecedented levels of connectivity. These factors have led analysts to believe that the country is entering a digital golden age. Holdings in the India ETF are screened to ensure the majority of their revenues come from internet and ecommerce activities in India.

The India ETF tracks INQQ The India Internet & Ecommerce ESG Screened Index (INQQETR) and employs an ESG screen.

- Grayscale Future of Finance UCITS ETF | GFOF seeks to provide exposure to the transformative companies that are, and could be, building the future of finance and our digital economy.

The companies are categorised across three core pillars: Financial Foundations, Technology Solutions, and Digital Asset Infrastructure.

Companies are further categorised across thematic exposures and business segments such as Payment Platforms, Exchanges, Miners, Asset Management, and Blockchain Technology. We believe that these are the sectors that will characterise, and shape, the future of the financial world.

The future of finance ETF tracks the Bloomberg Grayscale Future of Finance Index (BGFOFN), which is constructer to track the performance of companies that are shaping our digital economy.

- Sprott Copper Miners ESG Screened UCITS ETF | COPR provides investors with ESG exposure to copper miners.

Copper is a raw material that is essential to the transition to a less carbon-intensive economy. Copper is critical for the energy transition from fossil fuels to cleaner energy sources and technologies, and for the purpose of this index includes copper producers, developers and explorers.

The ETF tracks the Nasdaq Sprott Copper Miners ESG Screened™ Index (NSCOPE), which is designed to track the performance of a selection of securities in the copper industry.

Important Information. This communication has been prepared for professional investors, but the ETCs and ETFs referred to in this communication ("Products") may be available in some jurisdictions to any investor. Please check with your broker or intermediary that the product you choose is available in your jurisdiction and suitable for your investment profile. Past performance is not a reliable indicator of future performance. Product prices may vary and do not offer a fixed income. This document may contain forward-looking statements, including statements regarding our current beliefs or expectations regarding the performance of certain asset classes. Forward-looking statements are subject to certain risks, uncertainties, and assumptions. No assurance can be given that such statements are accurate, and actual results could differ materially from those predicted in such statements. Therefore, readers are cautioned not to place undue reliance on these forward-looking statements. The contents of this document do not constitute investment advice or an offer to sell or a solicitation of an offer to buy any product or investment. An investment in an exchange-traded product depends on the performance of the underlying asset class, minus costs, but is not expected to follow that performance exactly. The products carry numerous risks, including, general market risks related to adverse price movements in the underlying Index (for ETFs) or asset classes in addition to underlying currency, liquidity, operational, legal, and regulatory risks. In addition, with respect to Cryptocurrency ETCs, these are highly volatile digital assets with unpredictable performance.The information contained in this document is not, and under no circumstances should be construed as, an advertisement or any other action in promotion of a public offering of shares in the United States or in any province or territory where none of the issuers or their products are authorized or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information on this document shall be brought into, transmitted or distributed (directly or indirectly) in the United States. None of the issuers, nor any securities issued by them, has been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statute.

Advertising Message for promotional purpose - This announcement does not constitute an offer to sell or a investment solicitation. Please read carefully the characteristics of the financial instruments on offer and its associated risks, which are also present in the information provided by Directa ("Preliminary information", Section C - Information on financial instruments). ETFs, ETCs and ETNs (ETPs) and Certificates are complex financial instruments, with a significant risk of loss of the invested capital and whose price may include implicit costs. Directa therefore recommends to read the product offer documentation and the KID/KIID document, which describes the operating methods, costs and risks to which you are exposed by making the investment. The term "leverage" is used to describe investment strategies aimed at multiplying potential profits and losses. Leveraged investments may be made with the aim of obtaining possible higher returns, however leverage not only amplifies gains but also any losses. The investor is also exposed to the risk of early termination of the investment and of total loss of the invested capital or even more than it. The issuer pays Directa a fee upon execution, classifiable as an inducement pursuant to the Consob Intermediaries Regulation: for this reason, a conflict of interest may occur. - Grayscale Future of Finance UCITS ETF | GFOF seeks to provide exposure to the transformative companies that are, and could be, building the future of finance and our digital economy.